Sustainability led investment maintains growth in European thin wall packaging

20 March 2023

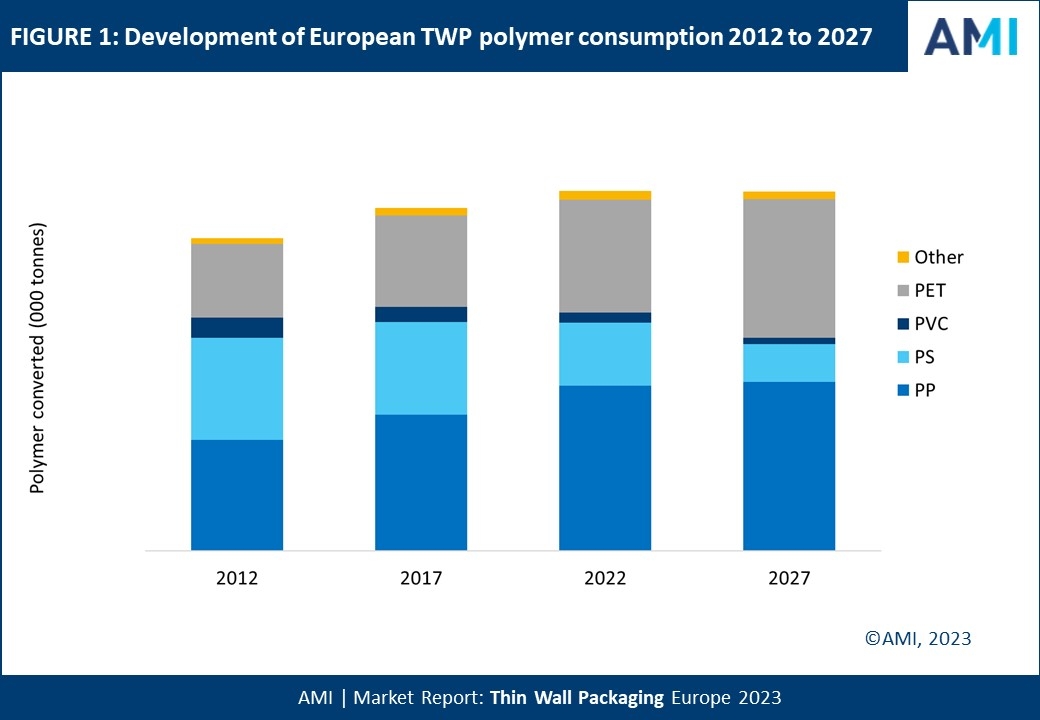

According to our latest market report, the European Thin Wall Packaging market has grown 1% a year to reach 3.4 million tonnes of polymer converted in 2022. The market has changed significantly over the last five years driven by legislation and plastics taxes, pressure from NGOs, brand owner/retailer sustainability commitments and consumer perception. This has resulted in changes both in the types of polymer converted and seen a shift towards formats perceived as more sustainable.

The functionality and cost effectiveness of plastic thin wall packaging has helped maintain a strong position within many key end-use applications: The ability to offer barrier, the move towards reusable formats and high levels of functionality regarding convenience and on-the-go growth have all offered opportunities. Although the market has reached saturation point in terms of volume expansion, growth opportunities abound throughout the industry offering profitable niches to ensure value growth is maintained and delivered.

As the industry approaches the sustainability milestone of 2025, growth in polymer converted for thin wall packaging is expected to stagnate. Certain end-use markets are under pressure from plastics bans and alternative packaging substrates, and lightweighting and plastics reduction initiatives continue. The popularity of hybrid solutions is growing as are developments in PET injection moulding, mono material barrier solutions, IML and many more. Lightweighting and other efficiencies remain top of mind for plastic packaging converters.

Consolidation continues to achieve economies of scale and efficiencies. M&A is taking place both horizontally but also into new verticals with thin wall packaging converters acquiring recyclers and capabilities outside their core material / plastics to add value and growth to their offering and support customers with packaging requirements.

There is unprecedented demand for mechanically and chemically recycled material, and bio-sourced material, and to meet PPWR targets, the availability of recycled content material needs to accelerate. Developments are taking place throughout the entire value chain to increase availability of and incorporate recycled material into thin wall packaging. Sizeable volumes of rPET are employed however rPET availability remains challenging. Tray2Tray initiatives are growing in momentum and will become more widely available as TWP circularity grows in importance. Advancements in mono-material PET tray solutions and progress on active barriers are increasing the attractiveness.

PP remains the main polymer consumed within the European thin wall packaging market but the development of food grade rPP streams remains essential to maintain its position. To this end, there is strong value chain collaboration in the development of smart sorting technologies and solutions to achieve FG rPP. Developments in partially renewable PP are helping reduce reliance on virgin grades. The outlook for PS is more challenging with continuing volume declines. Development of rPS streams and collection and recycling infrastructure will ensure volumes remain relevant, but AMI expects these developments to only slow the decline as alternative solutions are developed.

Efforts throughout the value chain on polymer and process development are providing opportunities, with mono-material, barrier and functionality advancements helping to maintain the attractiveness of thin wall packaging. Demand for reusable/durable formats are accelerating with PPWD and national legislation mandating reusability and providing opportunities. There is also a shift of sentiment to include compostable solutions, where a more coordinated approach may open future opportunities. The latest edition of AMI’s highly regarded Thin Wall Packaging in Europe report is the result of an extensive research program, providing a detailed independent assessment of this industry in times of uncertainty. The report quantifies resin demand for thin wall packaging by country, polymer and production method (extrusion thermoforming / injection moulding). This authoritative study highlights the development of the market for thin wall packaging over the past five years (2017-2022), how it is responding to sustainability pressures, and how the market is likely to develop over the next five years to 2027. Thin Wall Packaging in Europe 2022 is a detailed market report from AMI Consulting.

For further information please contact our Packaging Consultant E / susannah.owen@amiplastics.com

For sales please contact our Sales Manager E / brian.hinchliffe@amiplastics.com