PP Compounds aid switch to electric vehicles

8 September 2020

According to our new authoritative report published in September 2020, market penetration for Polypropylene Compounds is rising despite a slowdown in demand in 2020 triggered by Covid-19. The shift towards electric and hybrid electric vehicles, while threatening some existing underhood applications, is creating major new opportunities for PP Compounds in lightweighting and power management. Underway in the automotive industry are major changes in the supply-chain with many businesses facing existential threats even before the impact of Covid-19. The shift to electric vehicles and the prospect of autonomous vehicles puts pressure on OEMs as never before and opens doors for new entrants such as Tesla but with others following. These are choppy waters for companies to navigate through. PP/PP Compounds bring some inherent benefits such as low density but also have seen sufficient technical development to enable them better to compete in semi-structural applications.

The study segments the market by region, product family and application. Within the automotive segment, which is the largest market for PP Compounds, applications are split into interiors, exteriors and underhood.

The report quantifies in detail PP Compound demand by OEM as well as providing an analysis of the industry's supply structure and reviews the world's largest producers of PP Compound. The report examines the rate of structural change in the industry, current PP Compound capacity, capacity utilisation and investment plans. Much of the recent investment by PP Compounders has been to enable them to follow the manufacturing footprints of their major customers. The level of investment activity fell in 2019 in line with a weakening in market demand yet the likes of Borealis/Borouge, Celanese, GS Caltex, Kingfa, LyondellBasell, Advanced Composites, Mitsui, SABIC and Washington Penn are all seeking to grow.

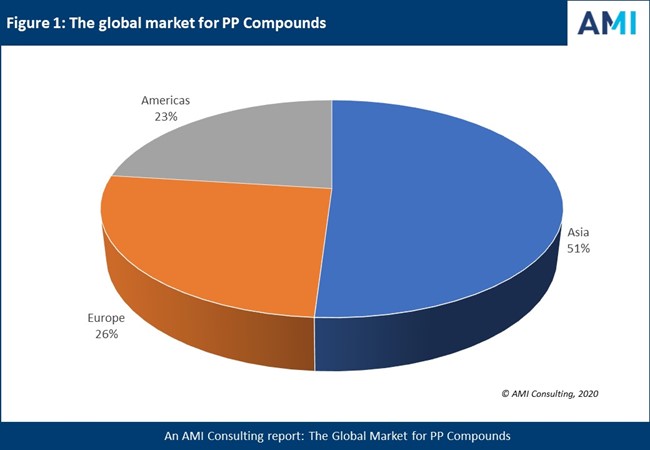

Mergers and acquisitions are most frequently driven by players seeking to grow either their product portfolio, their recyclate capability or their geographical reach. In 2019 Asia accounted for 51% of global demand compared with 26% in Europe and 23% in the Americas.

The report provides current and forecast information and is intended to support the strategic decisions that are required of participants to ensure they keep abreast of developments within this fast-changing industry.

AMI Consulting has published several multi-client studies in the field of PP Compounds including a report in 2019 called the European Market for PP Compounds and in 2017 a report called the Global Market for LFT (long fibre) PP Compounds.

This report is aimed at assisting industry participants in anticipating change, formulating strategies, directing R&D investment, and proactively managing threats and opportunities.

Contact sales@amiplastics.com to find out more.