High Barrier Films for Food Packaging Growth Advances

3 December 2024

While food packaging is largely recognised as a long-term and resilient industry during economic downturns, its enduring growth is surpassed by demand for high barrier films in food packaging.

In our latest market report "High Barrier Films for Food Packaging - The Global Market 2024", our expert consultants have combined first-hand industry insight across all polymer substrates with data analysis to give a comprehensive picture of this increasingly important sector. The research, which was released in November 2024, gives investors and industry participants a thorough grasp of the competitive challenges, market dynamics, and industry development.

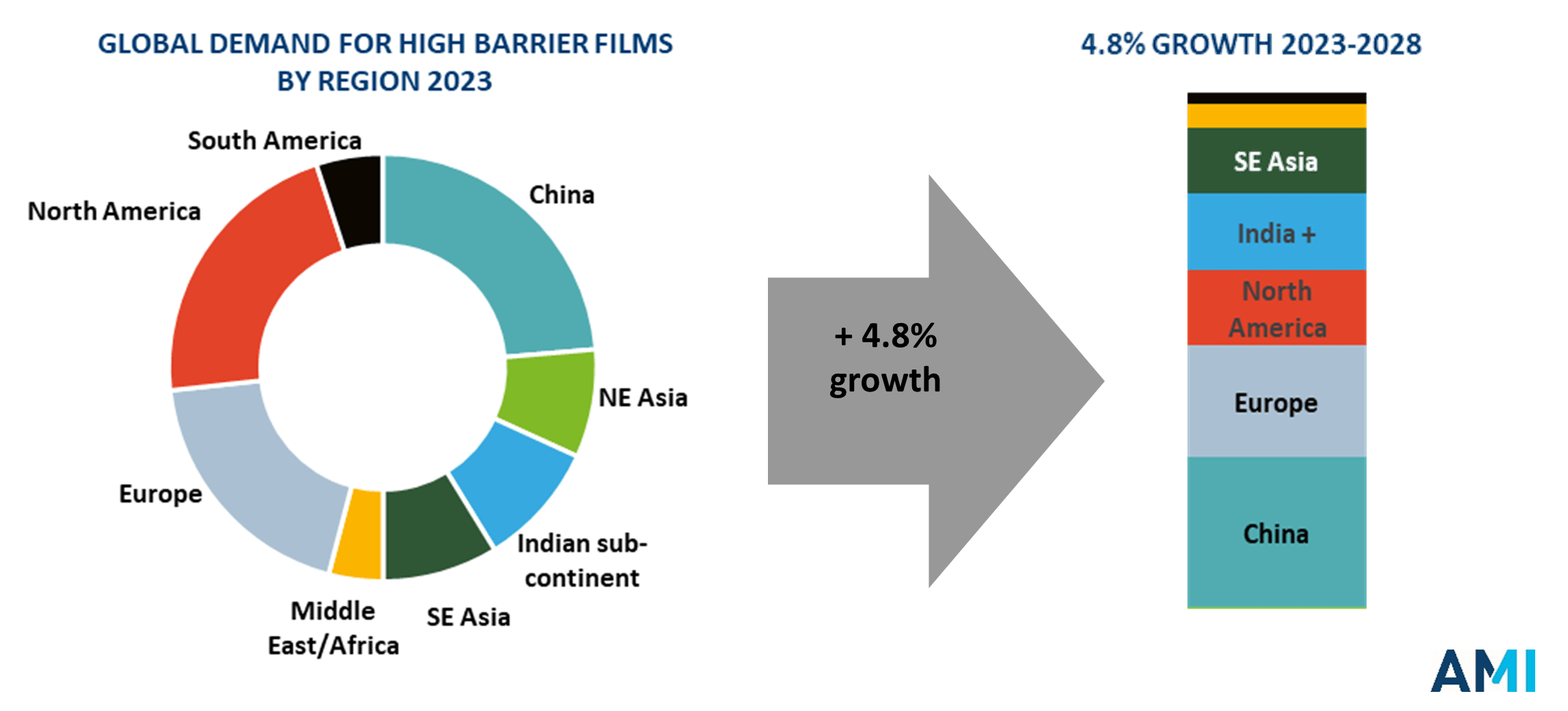

The report divides the global market into eight separate regions, differentiating between the four distinct markets of Asia, which show differing speed of growth, direction of growth and use of substrates and barrier materials with the Indian Sub-Continent enjoying the highest rate of growth contrasted with North East Asia, where demand for high barrier films is stagnant.

Growth drivers are varied and complex. Sustainability is a key factor in the rise in demand for high barrier films as these films serve to prevent food waste, reduce packaging and replace mixed material alufoil laminates. However, in developed regions, poor consumer perception of plastics could hinder growth, as brand-owners and converters seek alternatives through the use of paper, with many development projects and trials underway. Across Asia, more cost-effective mixed material laminates are expected to remain prevalent.

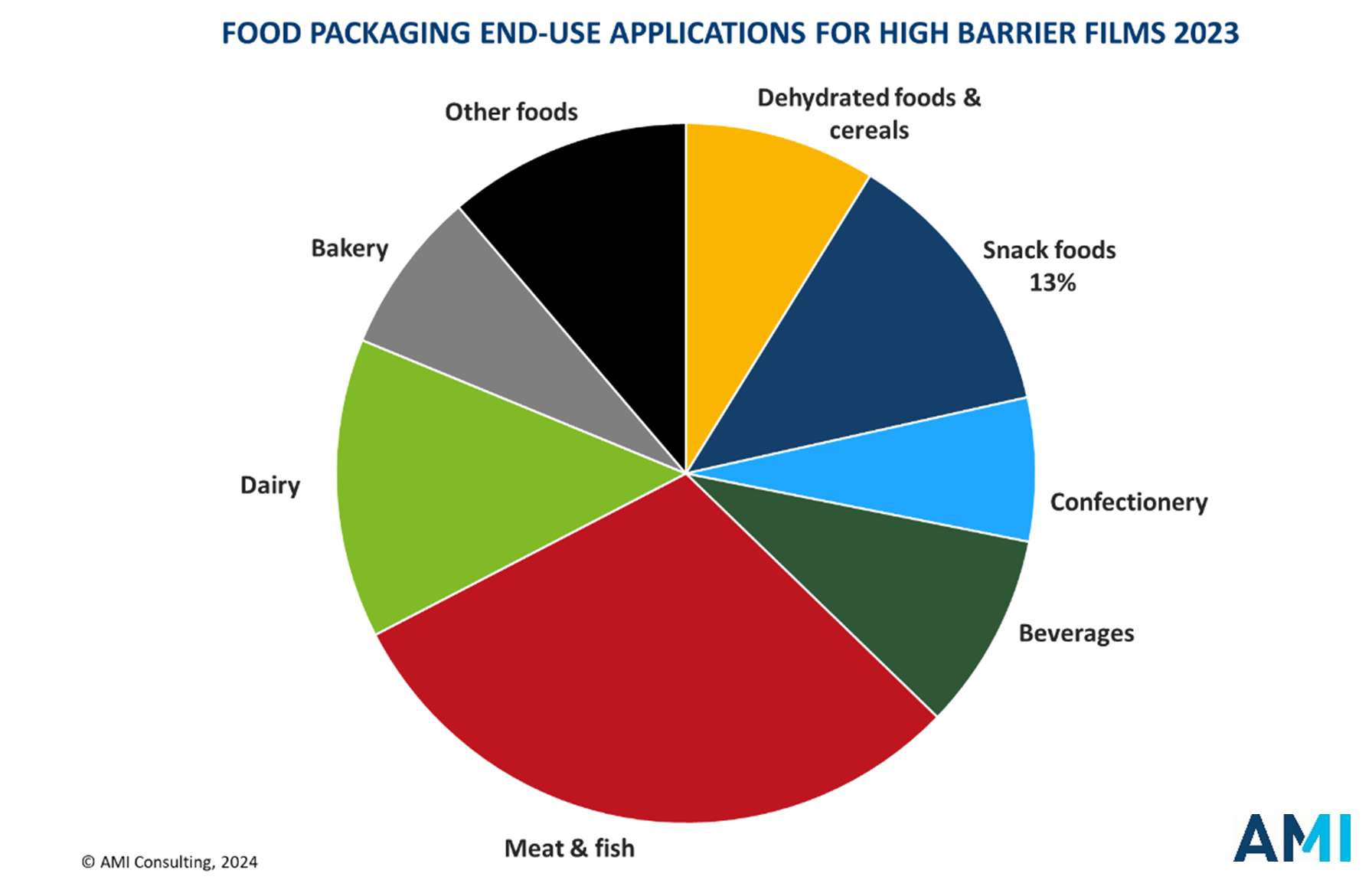

The report provides insights into the different reasons behind these distinct drivers for growth and offers analysis of future outcomes. The report covers all transparent and non-transparent barrier materials which are typically used to replace alufoil. It explores the significant future potential of emerging barrier and substrate materials, some of which accelerated in uptake during raw materials shortages. Chilled products such as meat/fish and dairy account for the majority of high barrier films applications in 2023, and whilst snack foods will be the fastest growing application, meat/fish will provide the largest volume growth as retailers seek to further protect this high value segment.

Advances in technologies such as MDO-PE and BOPE as well as improved coating solutions will enable further growth in the use of high barrier films for stand-up pouches and retort pouches, which are increasingly popular for their convenience features, while allowing for increased regulation for sustainability and recycling purposes.

The report will enable anyone using, converting or considering adopting high barrier films to improve their knowledge of the different barrier methods available, and which end-use applications have the best growth potential for each barrier material. Readers will obtain consumption data for each barrier type in each world region and get an independent assessment of the implications for future material sourcing.

The third edition of our highly regarded High Barrier Films for Food Packaging – the Global Market report is the result of an extensive research programme, providing a detailed independent assessment of this industry. We have been monitoring the trends in high barrier films since our first high barrier films report was published in 2015 and, building on the previous editions, this study has evolved into the most detailed analysis of high barrier films for food packaging currently available on the market. It represents an essential guide for industry players as they optimise business activities and plan future investments.

For further information and to request a report sample, please visit our website: High Barrier Films for Food Packaging – the Global Market