BOPP Film Demand Remains Strong as Consumer Habits Evolve

23 July 2024

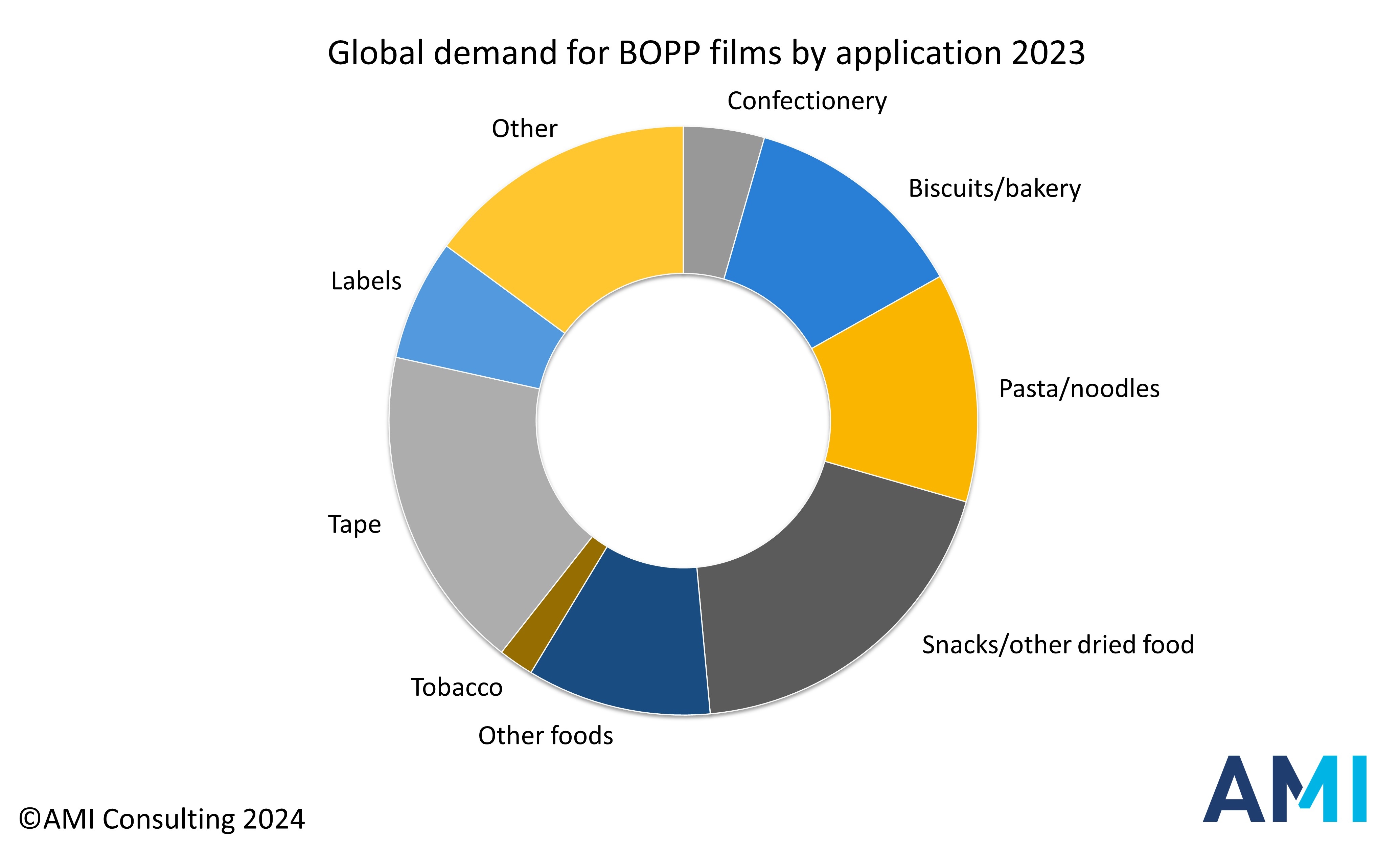

Global demand for BOPP films by application 2023

AMI, Bristol, 22/07/24 Despite a slowdown in mature markets, the demand for BOPP film in emerging markets is offering significant opportunities. In the latest market report from AMI, titled "BOPP Films - The Global Market 2024", our expert consultants have combined first-hand industry insight with data analysis to empower businesses to make informed decisions.

The report concludes that direct food packaging is still the most important application for BOPP films as modern retail caters to a market that craves packaged foods more than ever. Food security and convenience remain important drivers for packaged food growth in low-income markets. 58% of BOPP film demand is used for direct food packaging, and if labels are included, this rises to 65%. Snack foods are the most important food category for BOPP films by volume. Snacking and the consumption of packaged snacks for convenience is a growing trend, with busy on-the-go lifestyles encouraging more snacking occasions in all regions.

On the other hand, current inflationary pressures and geopolitical uncertainty have caused consumers to fall back on cheaper food staples such as pasta and noodles, commonly using high volumes of BOPP film for simple and efficient packaging and display. The diversity of markets for BOPP film is illustrated in the large volume in “other foods”, which covers a wide variety including frozen food and fresh fruit and vegetable packaging.

Snacks and other dried foods are forecast to provide the biggest opportunity for growth, particularly in emerging markets where per capita BOPP film consumption is lower and where convenient, protective packaging is still an appealing factor in food consumption, despite global commitments to packaging reduction and recyclability. Packaging converters need to keep abreast of such end-use market trends and understand how they are influencing BOPP film supply and innovation.

A Market Shift Towards BOPE

Within the flexible packaging space the latest solution predicted to develop into a viable mass-market option is BOPE film, thanks to the interest in mono-material structures and brand owner recycling commitments.

A key feature of BOPE is mechanical recyclability and now with established PE film recycling streams in place across many countries, this can be truly utilised. Sustainability and mono-material structures remain key drivers within flexible film research and development. A growing body of sustainability legislation, such as the Packaging and Packaging Waste Regulation in Europe, is impacting packaging development.

Investors in BOPE film extrusion are hedging their bets by installing hybrid BOPE/BOPP extrusion lines so that lines can be used for both materials. Others have modified existing lines to be ready to ramp up production when the market demands it, and only one company so far has dived in by investing in a fully dedicated BOPE line. But this opportunity doesn’t come without challenges and within this latest market report, AMI assesses the key players, market growth and potential in a chapter dedicated to this fast-developing new material.

The report will also enable users of BOPP films to improve their knowledge of end-use applications, demand and production in each world region and get an independent assessment of the implications for future material sourcing.

Also newly included in this report is a chapter dedicated to Battery Separator Films. With green industry and new energy becoming increasingly important, the use of BOPP in this segment is explored and analysed for the first time by AMI’s market experts.

Enquire about our latest report

If you’re interested in hearing more about the report you can request your free proposal that contains more detail on the structure and findings included in the report by visiting our website, just click here.